What is Investment Banking Operations?

Investment Banking is a special segment of banking operation that helps individuals or organisations raise capital and provide financial consultancy services to the clients. The investment banks act as intermediaries between security issues and investors and help them to new firms to go public. They either buy all the available shares at a price estimated by their experts and resell them to the public or sell shares on behalf of the issuer and take commission on each share.

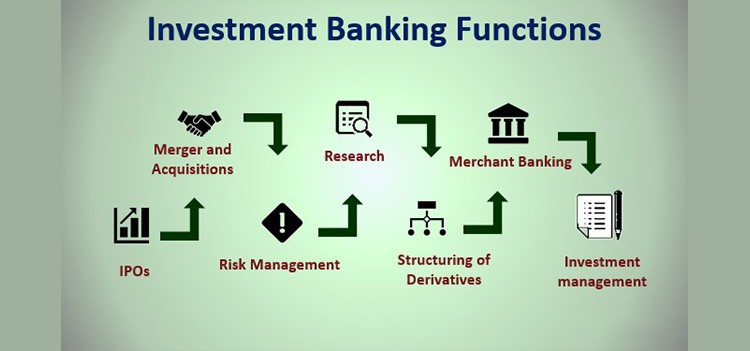

Investment banking is among the most complex mechanisms in the world. They serve many different purposes and business entities. They provide various types of financial services, such as proprietary, trading or trading securities for their own accounts, mergers and acquisitions advisory which involves helping organisations in M&As, leveraged finance that involves lending money to firms to purchase assets and settle acquisitions, restructuring that involves improving structures of companies to make a business more efficient and help it to make maximum profit and new issues or IPOs where these banks help new firms to go public.

Few lines about BBA Investment Banking Operations

BBA Investment banking operations is a 3-years undergraduate course that is divided into 6-semesters. The course is designed for careers in financial operations, capital market operations, treasury and clearing decisions within an investment bank. The course helps to learn about various product lines and gain a detailed understanding of the trade lifecycle across products and regions.

The course also trains the students on various investment banking techniques and also trains the students to deal with negotiations in large deals and acquisitions.

Eligibility for BBA Investment Banking Operations Course

The students who have completed their PUC or 10+2 with 50% from recognised board are eligible to apply for BBA Investment Banking Operations Course.

Admission Procedure

The students with relevant qualifications can join the BBA Investment Banking Operations course by two modes. The first one is Merit based admission and the second one is direct admission.

Let’s discuss in detail

1. Merit Admission

There are many top educational institutes that conduct entrance exams for the BBA Investment Banking Operations course. This mode is called merit admission mode. The entrance exams are conducted to select the serious and hardworking students from the group of non-serious candidates to the available limited number of seats in the colleges. The qualified students are allotted the merit seats and are given admission, the fees are fairly nominal for merit admissions.

2. Direct Admission

The students have another option of getting admission to BBA Investment Banking Operations course by direct admission process. Under this mode of admission, the students are given direct admission to their desired colleges under management quota. The direct admission students enjoy many special privileges like they are not required to apply for any institution-based entrance exam for getting admissions. They have an option to choose their desired colleges and book their seats even before the starting of the academic year. The students who are interested in direct admissions are required to contact Galaxy Educational Services for more details.

Course Curriculum

The students of BBA Investment banking operations will be studying the following subjects during their course duration.

| Sl No | Subjects of Study |

|---|---|

|

1. |

Fundamentals of Accounting |

|

2. |

Business Organisations & Environment |

|

3. |

Management Process |

|

4. |

Financial Accounting |

|

5. |

Quantitative Method for Business |

|

6. |

Organisational Behaviour |

|

7. |

Production and Operations Management |

|

8. |

Corporate Accounting |

|

9. |

Human Resource Management |

|

10. |

Service Management |

|

11. |

Corporate Environment |

|

12. |

Business Resource Methods |

|

13. |

Marketing Management |

|

14. |

Business Regulations |

|

15. |

Cost Accounting |

|

16. |

Entrepreneurship Management |

|

17. |

Computer Application in Business |

|

18. |

Management Accounting |

|

19. |

Marketing |

|

20. |

Investment Banking Operations |

|

21. |

Mergers & Acquisitions |

|

22. |

Investment Operations |

|

23. |

Global Stock Markets |

|

24. |

M&A |

Career & Scope

The BBA Investment Banking Operations students can find ample job opportunities in financial institutions. They are hired in global banks and global international markets.

Salary and Emoluments

The fresh BBA Investment banking operations students will be earning around 5 lakhs to 9 lakhs per annum. The experienced professionals will be earning around 9 lakhs to 12 lakhs per annum.

Top Organisations hiring BBA Investment Banking Operations students

Some of the top organisations hiring BBA investment banking operations students are:

- HSBC

- HDFC

- Kotak Mahindra Bank

- ICICI Bank

Placement Opportunities

Some of the important jobs available are:

Finance Manager: Every organisation has finance managers and they are among the top-paying jobs in the financial industry. They are responsible for all financial aspects of the business including risk management, planning, bookkeeping and financial reporting.

Accounts Manager: The accounts manager is responsible for the general accounting function and oversees the completion of ledger accounts and financial statements. Some organizations may require individuals to have a Certified Public Account (CPA) designation and at least seven years of experience in the accounting field

Finance Underwriter: The finance underwriters are hired in financial institutions. Raising capital is part of a bank’s underwriting department. Underwriting specialists typically focus on debt or equity and often have an industry-based focus as well. These bankers commonly serve in client-facing roles, working with outside contacts to determine capital needs while at the same time working in-house with traders and security salespeople to find the best options. Underwriting is not limited entirely to investment banks and has spread to larger universal banks to a great degree in recent years.

Hedge Fund Traders: Hedge fund traders are not working to satisfy client orders, but rather to maximize profits for the fund itself. Like buy-side trading jobs, traders at hedge funds may take orders from a portfolio manager or they may even be able to decide on their own buys and sells.

Economic Strategist: There is a fine line between a strategist and an economist. Economists tend to focus on the broad economy while strategists hone in on the financial markets. Strategist jobs are more likely to be found at banks and money management companies than in academic and government institutions. Many strategists begin their careers as research analysts, focusing on a particular product or industry.

Investment Analyst: Investment analysts typically specialize in one or more areas, including particular regions of the world, industrial or economic sectors or types of investment vehicles. Analysts working for sell-side companies will usually put out buy and sell recommendations for clients. Analysts working for a buy-side company will often recommend securities to buy or sell for their portfolio managers.

Financial Analyst: Financial analysts tend to work at more traditional (non-finance) corporations or government agencies. Nearly every large company, regardless of sector or industry, keeps financial analysts on staff in order to analyze cash flows and expenditures to maintain budgets and more. These analysts may also help to determine the best capital structure for the corporation or maybe to assist with capital raising. Financial analysts have the potential to rise through the ranks at their corporation, eventually becoming treasurer or chief financial officer.

Conclusion

The BBA Investment Banking operations students can find ample job opportunities in investment banks and global Banks. They are highly valued for their financial skills. They are also paid handsome salaries and can expect excellent career growth in the field. The student with a passion towards investment banking can join this course.